Modern retailing grows up rapidly, contending with traditional markets

VietNamNet Bridge – Modern retailing channels make up 20 percent of the domestic retail market, while the proportion keeps rising, expected to reach 40 percent by 2014, a report from Vietnam Report said.

According to the General Statistics Office (GSO), the total turnover of retailed goods and services in 2013 was estimated to reach VND2,618 trillion, representing the 12.6 percent growth rate over 2012. If not considering the goods price increase, the growth rate would be 5.6 percent.

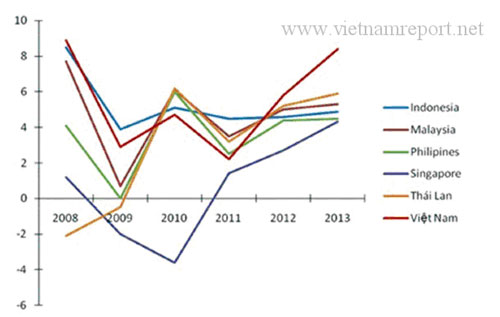

The retail turnover growth of the South East Asian countries in 2008-2013

What do international experts say about Vietnam?

Vietnam Report, after analyzing VNR 500, the Vietnamese biggest 500 enterprises, has found that the retail sector ranks the sixth in terms of the ROA (return on assets).

This means that this is a profitable business field where the businesses have been performing even better than in the finance and banking, real estate, telecommunication or transport.

The nine other sectors include mechanical engineering, food and beverage, chemicals, seafood, paper and printing, textiles and garments, agriculture, information technology and electricity.

The US AT Kearney, a consultancy firm, in its report about the Vietnamese retail market by 2014, showed that there are 638 supermarkets in Vietnam, 120 shopping malls and more than 1,000 convenience stores.

Experts believe that the retail revenue in Vietnam may increase by 23 percent per annum by 2014. The figure promises the great potentials of the market, where consumers tend to go shopping at big supermarkets and modern retail shops instead of traditional markets.

Taylor Nelson Sofresmarket also thinks the Vietnamese consumer goods market’s growth rate is much higher than that in other regional countries.

The conclusion seems to coincide with the EIU’s report on the Vietnam’s retail market prospect released in late 2012, which showed that Vietnam will remain the most attractive retail markets in 2013-2015.

The latest report about the Vietnamese retail market on Research and Markets’ website also pointed out that Vietnam is one of the five markets in the world which can bring the highest profits to investors.

The great interests in Vietnam paid by Takashimaya, Index Living Mall in Vietnam, the facts that Singaporean NUTC FairPrice joined forces with Saigon Co-op to develop two retail brands in Vietnam, and the expansion of a series of the operational retail chains in Vietnam such as HaproMart, FiviMart, Maximart, OceanMart, BigC, Vien Thong A, Fahasha, Nguyen Kim, HC, Tran Anh, Pico all can prove the high attractiveness of Vietnam in the eyes of investors.

The battle in the retail battlefield

The 2012’s turnover of the foreign invested enterprises accounted for 74.4 percent of the total turnover of the VNR 500’s retailers. Meanwhile, domestic retailers’ revenue just made up 25.6 percent.

Explaining the modest market share being held by domestic retailers, experts say foreign invested shopping malls enjoy larger custom because they are more professional in providing services, displaying goods, while they can supply large quantities of products.

Meanwhile, domestic retailers are weak in the investment capital and corporate governance.

Under Vietnam’s WTO commitments, from January 11, 2015, foreign retailers will have the right to set up their 100 percent of foreign owned enterprises instead of the 50 percent foreign invested enterprises as currently.

OTHERS

Viet Nam to be among world’s top 15 trading nations by this year-end

Trade poised for new record but sustainability concern persists: conference

Korea Zinc plans $7.4bn US minerals refinery with Washington’s backing

DAP – Vinachem Announces Decisions on Appointment of General Director and Chief Accountant

DAP - VINACHEM Achieves Record Revenue and Profit, Top of VINACHEM in 2025

Viet Nam to be among world’s top 15 trading nations by this year-end

17/12/2025Trade poised for new record but sustainability concern persists: conference

17/12/2025Korea Zinc plans $7.4bn US minerals refinery with Washington’s backing

16/12/2025Making Viet Nam a startup and innovation nation

16/12/2025